The idea of saving for a new home or new car, or perhaps planning a family or paying off college debt, can seem daunting. It can require long-term budgeting, restrictive spending and tracking every expenditure.

However, through a process called reverse budgeting, millennials can meet their financial goals without having to live within a spreadsheet. The concept focuses on how much you need to save, how to make those savings automatic and then how to spend the remaining amount of money.

For example, if you spent your budgeted amount for the month on dining or entertainment, and an unexpected expense arises, all you have to do is shift your spending elsewhere to align with your financial goal.

The beauty of reverse budgeting is that it focuses on saving, and you can’t spend what you don’t have. By reducing the amount you spend, you inherently increase the amount you save. At the same time, the process drives you to prioritize your expenses. Many people discover that the more they save, the easier it is to cut unnecessary spending.

Another benefit of reverse budgeting is the simplicity of the process. Unlike traditional budgets, which are time-consuming and require monthly or even weekly maintenance, a reverse budget can be set up for complete and easy automation, making it more likely that you’ll stay on track toward your goal.

Reverse budgeting can occur in three simple steps:

1. Determine the amount each month you need to save to obtain your goal.

Actually writing down the goal with an estimated date and expected cost can significantly increase your chance of achieving that goal. It also starts the process of identifying what things in your life are most important to you.

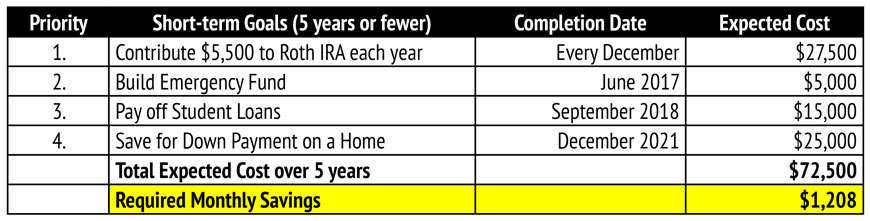

Begin with short-term goals (five years or fewer), the expected completion date and cost. Add up the cost of all your goals to determine how much savings are required each month to make your financial goal a reality. After you’ve completed this, prioritize your goals to give you an idea of where to direct your monthly savings.

Below are some examples of short-term goals that are totaled and divided by 60 months (five years) to determine the required monthly savings for reverse budgeting.

The same exercise can be done for intermediate-term goals (five to 15 years) as well as long-term goals (15 years or more). Don’t worry if you can’t come up with an exact cost to your long-term goals. The purpose is to get into the mindset of documenting your goal and getting a ballpark number of how much savings will be required.

Keep in mind, if you’re having trouble meeting the monthly savings you’ve determined to attain your goal, you might want to consider increasing your savings over time (step three) or taking a step back to look at what is most important to you. You may find you need to make adjustments your goals.

2. Set up a monthly automatic withdrawal from your checking account to a separate savings account.

Open a savings account, preferably one that pays a higher interest rate such as an online account, as opposed to one at a traditional brick and mortar bank. An added benefit of online savings accounts is that they curb impulsive spending, since it takes longer to access the money.

Once the automatic monthly withdrawal from your checking account to the online savings account is set up to meet the amount you reverse budgeted in step one, the process is complete. Any leftover money in the checking account is yours to spend freely.

3. Escalate your automatic savings over time.

This is the most important step for those who are interested in maximizing their savings as well as those who are struggling to meet their monthly savings goal.

Going back to our short-term goals example from step one … that example would require a savings rate of just under 10 percent for someone with a $150,000 income. Imagine this individual hasn’t been saving much prior to this exercise. In that case, suddenly removing $1,208 per month from his/her lifestyle can be a challenge.

Increasing your savings is a way to gradually advance towards your ideal monthly savings. Think of the automatic transfers from your checking to savings account like climbing a staircase. The first three months should withdraw $100 per month. The second set should withdraw $150 in the next three months, then $200 in the next, and so on.

If you are already meeting your short-term monthly savings target, then escalating savings over time is a great way to begin addressing those intermediate- and long-term goals.