Like Goldilocks, Millennials Are Seeking Financial Advice That’s Just Right

As Millennials are poised to become the largest generation of savers, supplanting Baby Boomers as the generation with the largest impact on the American economy, skepticism about investing in the stock market is surprisingly rampant and financial advice is often overlooked.

According to research released by Goldman Sachs last month, only 18% of the young adults surveyed trusted the stock market as “the best way to save for the future.” The flip side of that – uninvested – coin is that 82% of Millennials may not believe the market is their best investment choice: 20% because they “didn’t know enough about the stock market” and 16% because they thought “stocks are too volatile” or “the marketplace isn’t fair for small investors.”

With the S&P 500 historically producing average yearly returns of about 7%, savings accounts and CDs yielding 1% or less, and the jar in the closet 0% – why are so many younger investors choosing to sit it out? Diversified investment strategies that take risk-tolerance into account generally provide much better opportunities and results than leaving savings to trail inflation rates, and yet many Millennials are doing just that, preferring the piggy bank to the market.

Like Goldilocks, Millennials may be waiting for the bed, the chair, or the financial service provider that is “just right” but, unlike Goldilocks, they may not know where to look for the one that suits them best.

Financial Advice from Investment Companies

Large firms with high minimums and high asset requirements – and some fee-only solutions with daunting initial retainer fees – may be “too hard” for many Millennials, who are just starting out and find it difficult to come up with the minimums required.

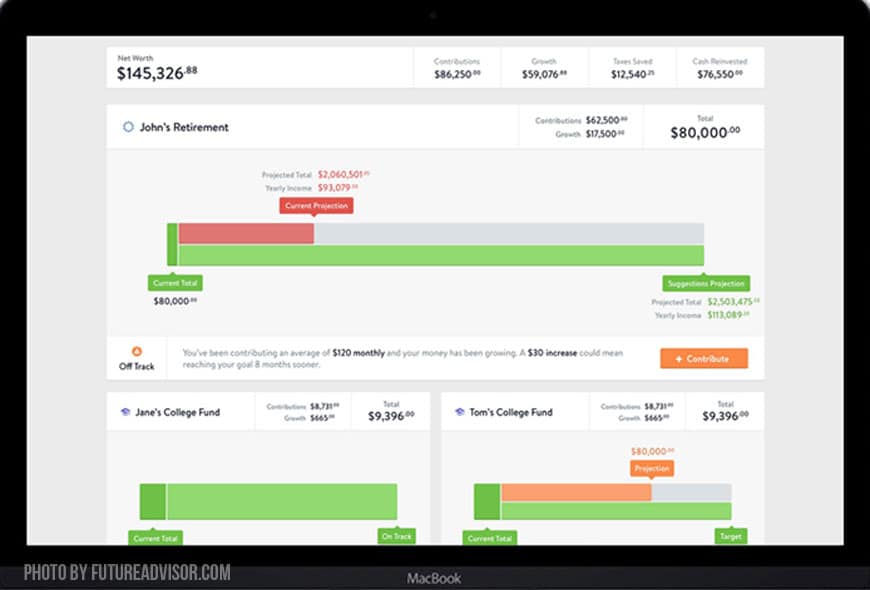

Algorithm-based “robo” solutions may be appealing in their affordability but, given that most provide a limited number of models, without customization or personalization, they may be “too soft” and too limited for many Millennials, who are looking for solutions that are more focused on, and tailored to, their individual needs, goals, and preferences. Many are investment services only and do not provide the kind of holistic financial planning that includes buying a first home, saving for education, insurance, estates and trust advice, and other important financial planning considerations.

While Millennials are waiting for financial advice that is “just right”, they may be losing out on significant future rewards. That’s because the earlier they start investing, the sooner they will begin reap the rewards of compounded returns and the more they can potentially earn from a company’s matching 401(k) program.

So what is preventing Millennials from finding the financial advice that’s right for them and finding it sooner rather than later?

Debt

Much has been written about the debt being carried by Millennials and it’s true that it’s an important factor. But without a thorough analysis of the interest rate they are paying on their debt, it can be difficult to determine whether it is more advantageous to save – and invest – or prioritize paying down the debt first. While it makes sense to pay down debt with a high rate of interest quickly, it is also wise to consider the potential advantages of certain savings opportunities such as employer plans that offer matching contributions.

Desirability

Millennials are often marginalized based on age or income and profitability when it comes to receiving financial services. They do not meet the minimum asset requirement for many larger firms, and even some smaller firms may not be interested in speaking with them. Some financial advisors may take on clients’ Millennial children as a value-added service for their older, more affluent clients, but those advisors may not always be giving the younger investor their full attention or understand the difference in their younger clients’ priorities.

Cost

Even fee-based services may be too expensive for younger investors who are just starting out. And Millennials may have been put off by experiences with smaller, non-fiduciary, financial service providers who may not understand their unique needs and goals.

Attention

Because they have easy access to a “wealth” of information on the Internet, 43% of the participants in the Goldman Sachs study said they would not spend more than an hour getting guidance on investing and 3% said that they wouldn’t seek any advice at all. This is the single most startling, and most worrisome, finding of the Goldman Sachs survey. Many young investors may have to learn the hard way that it’s not easy to build a solid financial future in one hour. Investing in a few productive hours with a good financial advisor can more than pay off in building a foundation for creating a strong financial future.

Comfort

As Goldman Sachs points out: “Millennials have grown up in a time of rapid change, giving them a set of priorities and expectations sharply different from previous generations.” Millennials have a distinct world-view, and are looking for advisors and advice that complement how them see themselves, their priorities, and their future. They don’t relate to large, detached firms; they are looking for personal – and personalized attention – something not all firms provide. With technological resources evolving daily and with data available almost instantly, digital natives feel more comfortable with advisors who understand and integrate the tech tools that can make the process more efficient. At the same time, paradoxically, they want connection and a personal relationship with an advisor who gets them, who gets their choices, relationships, and personal financial goals and can customize an individualized and evolving plan that is right for them.

Financial advisors have a lot of work to do, to connect with the youngest – and potentially most powerful – generation in history. Helping Millennials understand that debt, assets, cost, relatability, and efficiency are not barriers to entry is an important first step in helping Millennials on a path to a secure financial future. Providing them with the kind of customized, tech-savvy, and personalized service they expect is the next step.

But Millennials have a responsibility too, and it’s an important one because it’s a responsibility to their own future and finding a financial advisor who helps them focus on achieving their own, unique goals. As Carl Richards wisely wrote, “When it comes to investing, the only goal that matters is yours.” The sooner Millennials get off the sidelines, seek professional advice, then get started working toward achieving their own goals, the sooner they will be able to realize their own visions of a financial future that is “just right.”