These days everything is going paperless, including money. Not only can banking and investing be carried out from anywhere in the world with a click of a button, but there are a plethora of third party apps that can keep you connected to and on top of your finances. After sorting through many of them, here are the only three sites you will ever need to help manage and keep track of your money.

1. BillMonk.com – For all of your personal debts and debtors.

For anyone with roommates, BillMonk.com is an invaluable tool. The basic idea of the site is to keep track of who owes whom how much money for what – and the interface is much less convoluted than the latter half of that sentence.

You simply sign up for the site, and refer anyone who you share bills with to sign up as well. You then report a bill or a debt, and the website will send notifications to all who owe you money that the new bill is up. No more wondering if Bob has paid utilities for April, or if Sally is up to date on the cable bill.

The site has several other features beyond bill splitting including a “Shuffle Debts” feature that simplifies complex webs of debts between three of more people. (E.g. Sally owes Bob $100, but he owes George $300, who owes Sally $78 dollars, and all three of them owe Fred $34, who owes $100 to Bob). The site also has a feature to keep track of items that you lend out, so you always know who has your Lost Season 2 DVDs.

2. CreditKarma.com – Your one stop shop for a free credit score.

Unlike FreeCreditReport.com and FreeCreditScore.com, Credit Karma will actually show you your credit score… for free. The best part is that, unlike many “free” web apps, you don’t need to put in your credit card number to register.

For a free site, it’s not too shabby either. The website gives you three different scores: your TransRisk and Vantage scores, as well as an Auto Insurance score provided by TransUnion. And if you thought it couldn’t get any better, Credit Karma also offers tools to help you understand exactly why your score may be high or low, and if it is the latter, how to fix it.

With its new “Credit Report Card” feature, it simplistically breaks down the different factors that go into determining you credit score, such as the number of credit lines you have open, and the average age of each line of credit. There is also a social networking aspect to the site in the “Advice and Learning” section, which allows users to ask and answer any questions about their credit score. The only thing missing from CreditKarma.com is a string of annoying TV jingles.

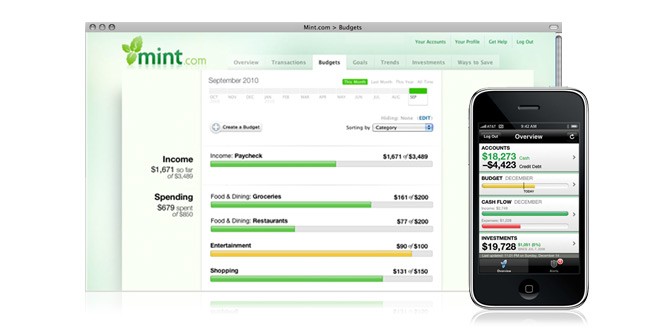

Mint.com is very well known and widely regarded to be one of the best free money management apps around. It allows you to sync virtually all of you financial assets and accounts to the site (banking, checking, saving, credit cards, investments, you name it), allowing you to see a complete picture of you finances in one place. By syncing credit or debit card accounts, it can also automatically categorize your spending to let you know exactly where your money is going.

It is also an extremely useful tool for D.I.Y financial planning. It allows you to craft a budget, as well as set goals for the future. It even has specific goal oriented tools to let you know how different goals (retirement saving, planning a trip, buying a car, and doing home improvements, among others) may call for different strategies for saving. And, similar to Credit Karma, Mint will give you personalized suggestions on how to save on anything from credit card interest to life insurance.