Chicago-based Michelle Winterfield is a co-founder and finance expert who specializes in couples finance. Her innovative fintech app, Tandem, simplifies shared expenses through planning, buying, and sharing. In just a few months since its launch, the Tandem mobile platform has already managed millions of dollars.

Michelle’s passion for financial insights led her to launch @missmoneymichelle on Instagram and TikTok where she educates over 200k+ followers with fun money tips. Before Tandem, Michelle worked as a private equity investor in Wall Street and was a former Division I soccer player for Michigan State University.

Millennial reached out to Michelle to learn about her life journey and trajectory to success.

How did you become a financial influencer, Michelle?

Accidentally! I started making a lot of short-form video content for my company, Tandem, around couples and money. I came up with a series called “Things Power Couples Do” and that really took off. However, I’ll preface that it took a LOT of trial and error to finally see success. Social media and content creation was not native to me.

From there, I realized I became very comfortable creating content that my target market engaged with. I wanted to expand my audience beyond just couples so I started my “influencer” profile on the side to share even more finance insights.

Now I run both Tandem’s and my own Miss Money Michelle profiles and love it. Building their respective communities has been so rewarding, and engaging with them and our users on the app is by far my favorite part of the job.

What characteristics did you have early on that aligned with a media career?

I actually grew up singing. I used to tour with Radio Disney and have performed for huge crowds (my largest was singing the National Anthem at the Final Four Basketball Tournament with a 70k+ audience and 16M+ viewers on TV!).

I wholeheartedly believe those experiences helped me to be comfortable on camera, where I now reach millions of people in a different capacity. Learning to be comfortable on stage has been directly transferable to being an influencer.

Explain some of the challenges associated with being an entrepreneur.

Every day is a battle. I think being able to cut out the noise and prioritize is the most challenging thing with being an entrepreneur. Whether that’s dealing with a tough macro economy or a rude comment on Instagram, staying focused on your “north star” is the key to navigating the bad days. I’ve learned that staying steady is very helpful – don’t get too high or too low.

Which skills do you recommend honing to succeed as an influencer?

I think time management and attention to detail are two of the most important skills for becoming a successful influencer. There is a lot of work that goes into very high quality content, and in order to get it out quickly you need to be an expert at managing your time. You also need to be relentless in ensuring your content is accurate and actually helpful for people. Paying attention to the details and doing your research will make that a lot easier.

What is your approach to fostering and maintaining relationships with your audience?

I interact with them every day. Whether that’s responding to comments, DMs, or just sharing my daily life. In order to cultivate a truly engaged community, they have to know you personally. So my advice is to let your audience in. If they leave, you didn’t want them there anyways!

How do you differentiate your style from your competitors?

I don’t really consider other finance creators “competitors”. There is so much room for content and people can follow as many profiles as they choose. However, what I do to keep my page unique is insert my own personality or opinion wherever I can.

Speaking of personality, why do you wear sunglasses in your videos?

When I first started making content it was for Tandem and I launched a series called “Things Power Couples Do”. I thought the sunglasses would be a fun, satirical add that may make people think “what does this girl in the big shades have to say to me?”. Since then it’s just been my signature thing to wear sunglasses in all my videos, I think it helps people recognize me! And I never have to waste time doing makeup before filming…

Tell us about the Tandem app for couples finance.

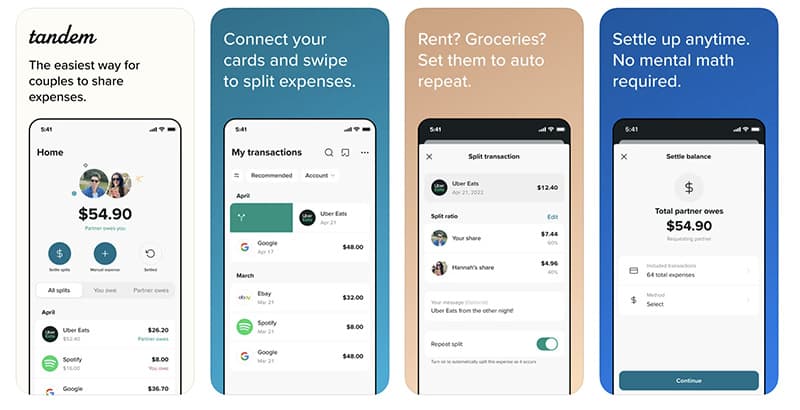

Couples are getting married later in life, and many now struggle to access money milestones at the age previous generations achieved them. Tandem helps millions of gen z + millennial couples navigate their first money moments and ultimately their financial futures together.

Previously, they were stuck with the choice between keeping track on a spreadsheet and sending Venmo requests or jumping to a joint account. Tandem eliminates the back-and-forth of P2P applications without the need for a joint bank account or card.

- It allows you to maintain privacy because your partner cannot see your individual transactions, only the transactions you choose to split with them

- You can divvy up expenses however works best for your relationship — you’re not confined to doing it 50/50.

- You can opt to automatically split repeat expenses with your partner.

Since launching last August Tandem has helped couples manage tens of millions of dollars of expenses and has been featured as a top tech trend on the NBC TODAY Show.

And the concept of Miss Money Michelle?

I was actually inspired by my girlfriends to start Miss Money Michelle. There is a big group of us and we all have taken completely different career paths. I realized that if you don’t work in a job that touches money, it is incredibly difficult to create the time it takes to learn about all the different aspects of investing, managing debt, how to use a credit card to your advantage, everyday savings tips, etc.

The market research and user interviews we’ve done for Tandem also validated that a lot of people did not have the most basic understanding of what to do with their money. It motivated me to create content for a broad audience to share all of the finance learnings I’ve been fortunate to gather through my career path and passion for financial wellness.

I hope that through my content I can provide people with some very simple and actionable insights to make them more confident about their ability to grow and manage their wealth.

How did you raise funding for Tandem, and subsequently the MissMoney brand?

We raised capital for Tandem from venture capital funds, which allowed me to learn and pursue content creation seriously. This is probably more of a unique situation given I started with a company before I was an “influencer” and now it sort of blends together.

However, before starting my company I saved a lot of money knowing that I would likely be taking a sizable pay cut while building. I would absolutely advise anyone who is interested in doing content creation to do the same if you are earning a salary now!

What is your top priority for the future of your brand?

I want my brand to be one that is considered very approachable and empowering. I find the companies and people I am most drawn to are the ones I can see myself in. I want people to feel like they are part of something when they join my community and that nothing is out of reach. I think the best way to achieve this will be by being very candid and transparent about my own challenges and learnings.

To learn more about Michelle Winterfield and her couples finance app, visit the Tandem website or follow her on her social media channels below:

YOUTUBE

TIKTOK

View this post on Instagram