If your New Year’s Resolution is to finally stick to a budget, a diet, or a fitness plan, you’re in great company: you’re one of millions who resolve each January to do better in the new year.

So why is it that so many resolutions – from financial fitness to learning French – tend to fall by the wayside come February?

The answer may be a surprisingly simple one: we treat our New Year’s resolutions like a 50-yard dash instead of a marathon.

So while you may be full of resolve and determined to crush it this time, don’t set yourself for a fall: learn from marathon racers about how to weather the inevitable highs, lows, and disappointments, and still achieve your goals of financial fitness.

Marathon runners don’t overreact to bad days

A sprinter aims to hit January 31st with a perfect record of zero sugar or zero financial splurges. That’s why giving in to that “one slice” of cheesecake or that great markdown on winter boots can be discouraging and lead to avoidance, by not writing it down in your diet or budget journal, for instance, or giving up.

A good marathon runner isn’t discouraged by a small slip, though. That’s because they see the arc of their training over years, not weeks or just one month, which gives them lots of time to get back on the wagon if they fall off. The same thing with saving and investing: if you keep your long-term goals in mind, and see financial fitness as a month-to-month trend rather than a perfect monthly record, you’re less likely to give up after a little slip or bad patch.

Tip: Don’t give up if you haven’t met your savings goals by the 50-yard line. Stay the course by remembering you’re in it for the long haul.

Marathon runners don’t give up because their progress is slow

You’re not always going to have the same momentum when you train: a challenging terrain can make you feel like your progress is slowing down instead of speeding ahead as you struggle with hills, bumpy roads, dehydration, and the occasional sprained ankle.

A good marathon runner knows that progress has it’s own timeline: the important thing is to build stamina before speed and to keep going, no matter what. A good investor learns not to be overly fearful of market volatility and to stick with a strategy through market ups and downs and dry spells. Furthermore, a good investor doesn’t give in to “loss aversion,” which is a reluctance to invest because the fear of losses outweighs the satisfaction of gains.

Tip: Don’t drop out because you hit a bump in the road. Smart investors hang in there through the hills and the dips so that they are buying both low and high.

Marathon runners prepare themselves

When you’re in it for the long haul, you need to be well-prepared, well-coached, and well-equipped.

Just as a marathon runner prepares with great nutrition, great coaching, and professional clothing and gear, a good investor prepares with adequate cash reserves and minimum debt, top-notch advice, and the best, low cost, tax-friendly investments they can.

The best way to keep New Year’s resolution is to make them specific, actionable, and above all realistic. No one who decides to train for a marathon expects to be in shape within the first month, or gives up if they have a bad day, or skip training for a day or two. If your goal is to achieve financial fitness, think like a marathon runner: lay a solid foundation, get the tools you need; start small and steady; don’t give up if you don’t see instant results; and remember that you’re in it for the long haul.

Tip: Getting into great financial shape isn’t just jumping into the market. It’s setting the stage for long-term success. Take small steps at first, and prepare well – make sure you’re laying a solid financial foundation. Make hiring an investment advisor a New Year’s resolutions as well.

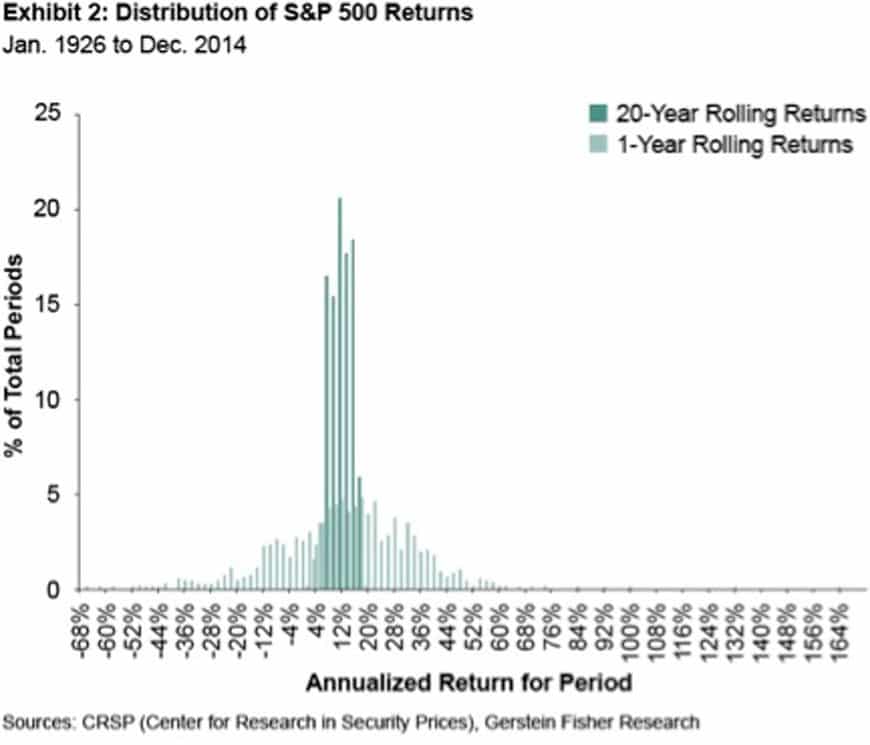

The chart below shows the value of a long time-horizon through ups and downs, showing the difference between returns with a 20-year time horizon vs wildly varying one-year rolling returns.

“Brad Sherman is an Investment Advisor Representative with Sherman Wealth Management, LLC, a Registered Investment Adviser. This content is solely for informational and educational purposes.”