These days, loaning money is often seen as part and parcel of life. Whenever you purchase through PayPal or similar, you’re sold a credit option like you’d be crazy not to take it. Car financing is now standard for 85% of vehicle owners and, let’s be honest, the vast majority of us wouldn’t think twice about contacting the bank if money was tight one month.

This has led to an ever-worrying ‘money-loaning mindset’ that’s seen escalating average debts of around $90,460 when you add everything from consumer debt through to student loans.

Unfortunately, once we’re in it, debt can be incredibly difficult, if not impossible, to get out of. Rises in high-interest ‘payday loans’ or quick-fire lending options are especially facilitating this problem, creating a ‘snowball’ effect that means either loaning more money or taking out consolidation loans.

Instead of taking preventative measures after a debt has accumulated, consumers need to change their mindset for borrowing in the first place. After all, companies have a whole lot to gain by making you think about lending as standard. But, the fact remains that debt in all its forms facilitates more debt, and generally leaves your finances in a muddle.

So, in true prevention rather than cure style, change here starts before purchases are even in your basket – the dilemma is how exactly you’re going to step away from an American dream that you’ve been sold for so long. Here, we’re going to look at a few anti-loan steps you can take to change your outlook next time you’re thinking of purchasing a high-ticket item.

Step 1: Treat honesty as the best policy

We live in a capitalist culture, meaning that we’re all predisposed to believe that bigger is better. As such, when the next car release or new iPhone hits the market, many of us feel that we need to have it in our lives. We might even convince ourselves that we need it for work/looking after the kids/whatever other excuse you can think of. It’s all the same, and it all leads to one thing – another substantial purchase that you’ll probably either take out on finance or seek a loan for. Why not, after all?

We can think of a great many options, including the fact that, disguised as they may be, even car financing and phone contracts are forms of debt, adding to the snowball that you clearly want to get out of given that you’re reading this article. More importantly, perhaps, is the fact that these loans are entirely unnecessary in the grand scheme of things. It’s certainly not worth getting yourself into debt for an item that replaces a perfectly good alternative that you’d already paid off debt for!

As such, our first step towards changing your mindset is to simply think long and hard about whether any given purchase is truly worth loaning money for. It can be a surprising question to ask ourselves, especially if we’ve previously been in the habit of lending first and thinking later, but it’s amazing how much even this pause can make a difference. Predominantly, it’s important to remind yourself that loans only ever originated as a fast-fire monetary solution for individuals in dire straits, NOT those who wanted the next best gadget. To ensure genuine honesty when considering your next purchase, be sure to take into account –

- The urgency with which you need the item

- The lasting investment the item offers

- The quality of products that you’re looking to replace

Keep these questions in mind for every potential loan, and the chances are that you won’t be quite so keen to jump into bed with the bank!

Step 2: Take time to understand the alternatives

Many of us have been led to believe that lending or financing is the only way to afford high-end items and, certainly in the short-term, this can be true. But, let’s not forget that you end up spending significantly more over time when you borrow money or pay for items this way. Interest certainly renders the whole convenience of expense argument null and void!

Hence why, on this journey to rewiring your outlook, it’s also fundamental to remember that there are alternative options. This sounds simple enough, but it’s surprising how few of us remember that we do have the choice to save our money for items (more on the long-game later,) or sell things that we own and no longer use to finance new purchases. Of course, this mindset is somewhat evident in car financing, for example, when we can part-exchange old vehicles, but the narrative is still pretty negatively against the idea of affording things yourself.

Of course, selling small things like clothing and unwanted toys online probably won’t help to finance a new car (though it might help,) but most of us have more money sitting around at home than we realize. Jewelry collections, especially, can provide surprisingly lucrative results, and something as simple as listing old rings on an auctioneer’s site or contacting a premier Rolex buyer like Diamond Bank can see that money in your bank as soon as any loan could offer it. Equally, increasing our earnings through outlets like side hustles in our free time can lead to income boosts that see us buying big items without even feeling the sting. And, none of these solutions brings a cartload of interest or escalating problems along with them!

Step 3: Learn to play the long-game

Ultimately, this loan-led culture is fueled by one simple thing – the belief that we need to have things now or not at all. The continual turnover of modern items feeds into this, making us feel that we have to purchase things the moment they come on the market when those items are at their highest price points. Again, this is the crux of capitalism and is really where the market for short-term loans that pack an interest punch finds its footing.

To break that negative cycle, it’s essential to rewire ourselves to a longer game where our money habits are concerned. This is something that most of us understand when we’re children, collecting small amounts of pocket money that we save towards much-desired toys. But, as soon as we start earning and open ourselves up to options like loans, we forget that skill altogether. Fundamentally, this is our biggest downfall and our worst precursor to debts.

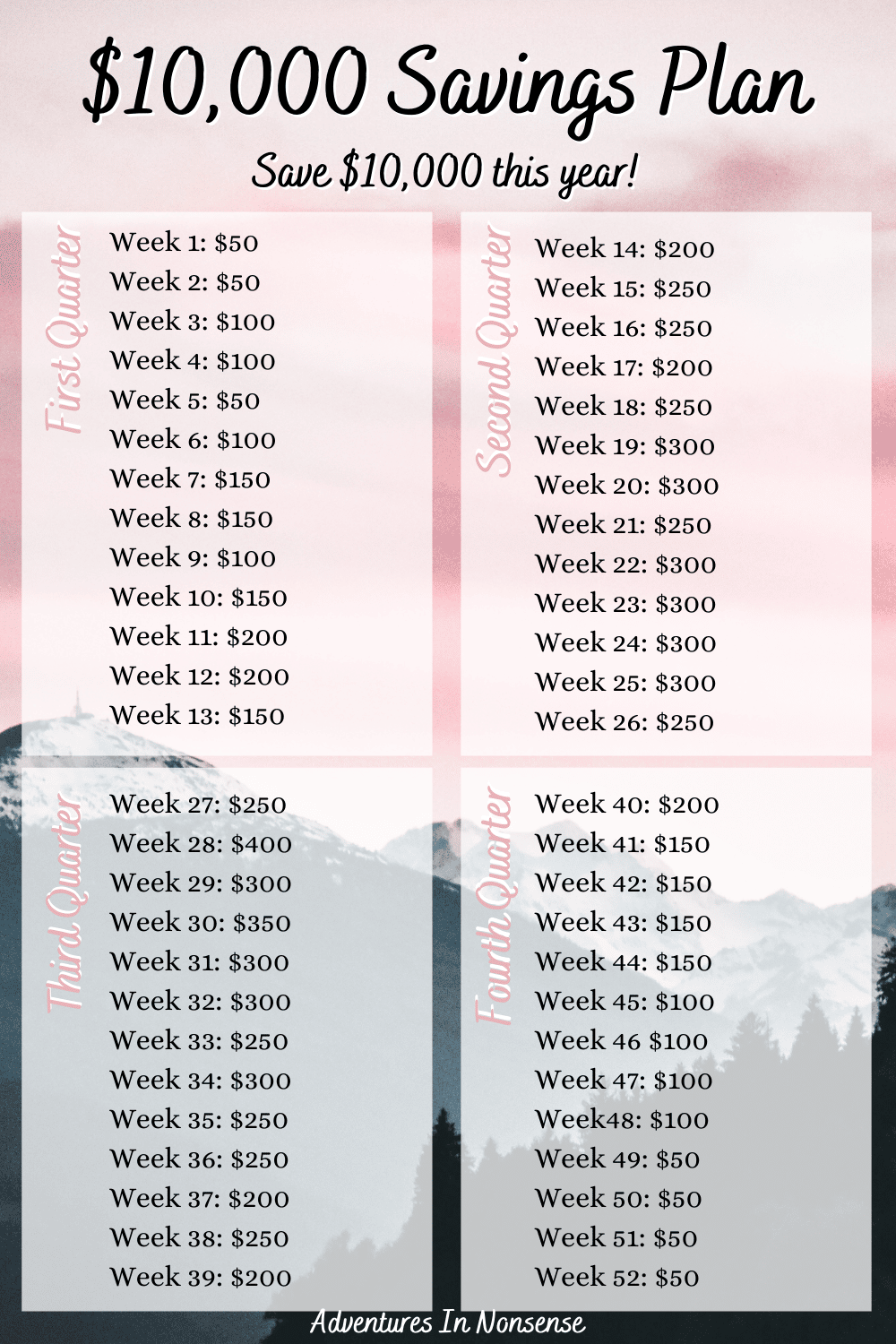

Stepping away from this cycle largely means getting a hold of money, and developing a better understanding of our finances where they are, and what we need to achieve wider financial goals. Specifically, accepting that we can’t have everything we want right away provides us with the time we need to develop reliable savings plans, alongside a rough timeline as to when those goals will become possible. Even if that time frame seems extreme when you first start saving, the chances are that a deeper delve into your finances reveals that you’ll own the items in question far sooner this way than you would if you were to borrow and pay bit-by-bit.

A final word

Loaning money is a norm in the modern age, and norms like these are incredibly difficult to break, especially when everything seems tailored towards them. But, with average debts rising and term loans extending to boot, something certainly needs to change. That shift undeniably starts with your mindset, fueling positive purchases in the future, and ensuring you can be debt-free far sooner than you would if you simply carried on borrowing.