Debt consolidation is the process of combining all your unsecured debts into a single monthly payment. Consumers can use debt consolidation as a tool to make it easier to repay student loans, credit card debt and other types of debt that aren’t tied to an asset.

One way to achieve debt consolidation is with a debt consolidation loan that combines several unsecured debts into a single, new loan. The new loan is often more favorable to the borrower and can result in a lower interest rate, lower monthly payment or both.

How does debt consolidation affect student loans?

Consolidating student loans can be practical for some borrowers because many loans don’t qualify for Public Service Loan Forgiveness. The ineligible loans can be rolled into a Direct Consolidation Loan, making your new loan eligible for PSLF. Be aware, however, that parent and student loans can not be consolidated into one loan.

Debt Consolidation Vs Debt Settlement

Debt consolidation is not the same as debt settlement. In debt consolidation, you pay your debt in full with no negative consequences to your credit while making one monthly payment rather than several. The theory is that one payment will be easier to manage.

Your goal should be to lower the interest rate and the monthly payment while paying off your debt more quickly.

Debt consolidation options

Consolidating your student loan debt with a home equity loan can be risky since your unsecured debt would then become secured by your home. If you can’t afford your new mortgage payments, your home could face foreclosure. That would not happen if your unpaid debts remained on separate credit cards.

If you hire a debt consolidation company, your loans may not necessarily be consolidated with a loan. Instead, your debts remain separate, but your payment is consolidated. You send one monthly payment to the debt consolidation company then that company divides your payment and sends it to all your creditors.

Beware of scams

The debt consolidation industry is full of scams. It’s easy to run into a company who may push you to get a high interest rate loan that really costs more in the long run than paying your debts off on your own. Other companies pocket your monthly payment instead of sending it to your creditors, leaving you with damaged credit.

You can consolidate your federal student loans for free via the Department of Education’s direct consolidation program at StudentLoans.gov . For instance, if a student has both a Perkins loan and a Stafford loan, you can merge them into one.

Alternatives to debt consolidation

If traditional loan consolidation is not an option for you, there are other means available to ease out the burden of a student loan.

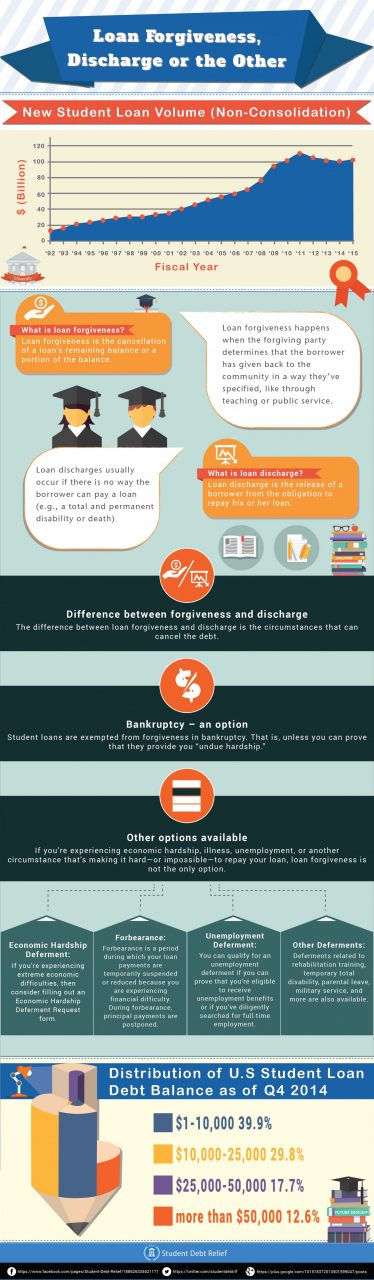

The following infographic illustrates a few of those alternatives:

Infographic Source: Loan Forgiveness, Discharge or the Other