Over the past few years, many have chimed in to tell us that we’ve entered a ‘new normal’ – a new economic environment of slow to stagnant growth that’s not going away anytime soon. Well, in some ways we have and in some ways we haven’t. It’s important we understand the details. This is part 1 of what I’m calling ‘What will the new economy look like?’ series. In these writings I’m going to tell you exactly what our economic research is pointing to and how you can protect your future, pay off debt, and build real wealth.

Throughout history, events have occurred that have shaped the way individuals build wealth. Every so often, certain things happen, many times very secretly, that alter the rules of wealth creation.

In 1913 a group of wealthy and influential men secretly traveled separately to Jekyll Island, South Carolina. These men were told to tell no one where they were going and, as they were traveling, they were instructed to use first names only. These men were meeting to carefully craft what we know today as the Federal Reserve Bank.

On August 15th of 1971 President Richard Nixon interrupted the TV show Bonanza in order to let the country know that he would be taking the U.S. dollar off the gold exchange system.

In 1980 Congress enacted the 401(k) qualified plan system through ERISA.

In the mid-90’s President Clinton pushed for housing reform to allow people to buy homes with less or no documentation of income and savings. Then, in the early 2000’s, President Bush did the same.

After the 9/11 attacks Fed chairman Alan Greenspan lowered interest rates in an attempt to get the economy growing again.

And finally, from 2008 to today [2013] nearly every branch of federal government has passed some sort of excessive stimulus… over and over and over again.

What do all of these incidents have in common? Each of them, in one way or another, created some type of money fad or monetary manipulation that we must comprehend in order to most effectively understand the economy and how to manage our own money.

The Great Misconception

From 1901 to 1979, the Dow Jones Industrial Index grew at about 3.6% per year.* From 2000-2012, the Dow grew at about 2% per year. So where does this idea of a eight, nine, or ten percent return in the market come from? In the wonderful 80’s and 90’s the Dow grew at over 14% per year (from 1980-1999). Why? Well there were a number of factors, including the extraction from the gold standard in 1971 (this gave The Fed the ability to print as much money as it saw fit) and the dot com bubble. You might call this period ‘The Roaring 90s.’ But the main reason for the excessive growth was the implementation of the 401(k) type plan in 1980.

In order to move forward, I believe, we must clearly understand two things:

- One – the market has never passively produced magnificent returns over a long period of time (aside from the 80’s and 90’s).

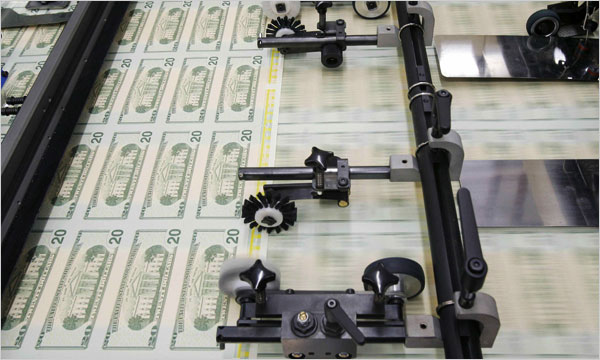

- Two – in my opinion, the only reason we’ve seen good stock market growth in 2012 and 2013 is that The Fed has been printing money like it’s going out of style. This cannot end well.

So where do we go from here?

Understanding that the stock market has rarely produced strong returns over a long period of time, I think we have to begin to look to ourselves for the solution. That’s right – WE are the solution. The only way to build real wealth is to develop our own expertise(s) over time. Maybe it’s real estate. Maybe it’s graphic design. Maybe it’s accounting. Maybe it’s… fill in the blank.

I’m blessed with the opportunity to work with a good number of Baby Boomers everyday and, with due respect, many of them still cling to the idea that all they have to do is shove money into their 401(k)s and they’ll be rich someday – so that’s what they tell their kids. But the reality is that this won’t work.

We have to think differently, creatively, and objectively. For me that means looking into why smart people are so big on gold and silver, investing in alternative assets like the Infinite Banking System and cash-flow real estate, and learning to pay off debt the way the wealthy do.

Stay tuned for part two…

*Source: Pinnacle Date Corp.

[sdonations]2[/sdonations]