Millennials are often portrayed as the irresponsible generation: the smart phone addicts, the money spenders and the “all about me” age. Not only is this stereotype of Millennials wrong, it also makes hidden assumptions about the largest generation in America, including that Millennials don’t want to marry.

More than 80 percent of Millennials say they think they will marry. That’s more than Gen Xers and Baby Boomers did at the same age. Millennials also say they are more likely to have children than prior generations. Marriage isn’t the only thing people have wrong about Millennials. This generation is more optimistic and responsible than people think, particularly when it comes to finances.

When getting married, or in a serious relationship, finances are one of the most important issues to consider. Although discussions will be different for each couple, here are some important money conversations to have with your partner – before you tie the knot.

Are your money personalities compatible?

You know the saying, “Opposites attract?” That might not be the case when it comes to how you spend your money. Knowing how both people in the relationship handle money is a big indicator of what each considers a priority. While your partner may find a $100 monthly gym membership critical, you might prefer to put that money towards boosting your emergency fund.

Consider taking a money personality quiz and discuss the results with your partner. Knowing who is a spender and who is a saver will be helpful for managing finances as well as holding each other accountable for making smart money choices.

Will you say “I DO” to joint bank accounts?

Some couples combine their accounts, some manage money individually and others will opt for a combination of both. It’s common for couples to keep their own accounts for spending and have a joint account for household bills.

Couples could also consider opening a joint account before getting married; this can be especially helpful if you are paying for the wedding. Today, couples contribute an average of 43 percent to the overall wedding budget. Having a joint account already set up also makes it easier to deposit wedding gifts of cash and checks.

What are your future goals?

Hopefully, you and your significant other have already discussed your future lifestyle together. It might include having children, climbing the corporate ladder, traveling extensively or even moving abroad. Have you discussed how you will be financially prepared for these goals?

Discuss your future plans together in as much detail as possible. Maybe you want to buy a house and raise a family. What type of house do you want and where? How many children do you want to have? Do you plan to fund their college educations? Your financial plan will change drastically depending on the answers to these questions.

Now is also a good time to consider speaking with a financial professional. Having a trusted third party to help guide your financial decisions and hold you accountable to your goals will help alleviate stress and neutralize potential conflict between you and your mate.

Are you bringing any debt into the marriage?

Millennials know the burden of student loans all too well. With the average student loan debt at $33,000, it’s likely that one or both of you carry some type of debt. In fact, 20 percent of Millennials have postponed getting married because of the unstable economy.

During this conversation, it’s important to be honest about your financial situation with your partner. Money problems are the third most common reason marriage ends in divorce, so start your marriage off on the right foot, even if your finances aren’t in order. Honesty is always the best policy when it comes to shared finances.

How do you imagine growing old together?

Retirement seems like forever away, but it’s important that you put money away today so you can enjoy the retirement of your dreams down the road and take advantage of compound interest over the maximum number of years you save.

Whatever the future looks like, be sure you consistently save for it. Monthly payroll deductions and auto-withdrawals to a 401(k) or Roth IRA are an easy way to save because the transaction is automatic and prevents the temptation of having the money sitting in your checking account. You can also take advantage of any company match.

When considering your future together, don’t forget to consider how you’ll protect as well as grow your income and savings. No one likes to think about a disabling accident, illness or death, but one of the most important ways you can protect your family is by having insurance policies in place that help you plan for the unexpected. There are also living benefits to consider when it comes to certain types of life insurance policies.

Talking about money can be difficult and even awkward, but having these discussions will help you face some of the challenges that come with marriage. Starting your marriage in a healthy financial place will make growing old with that special person even more fulfilling.

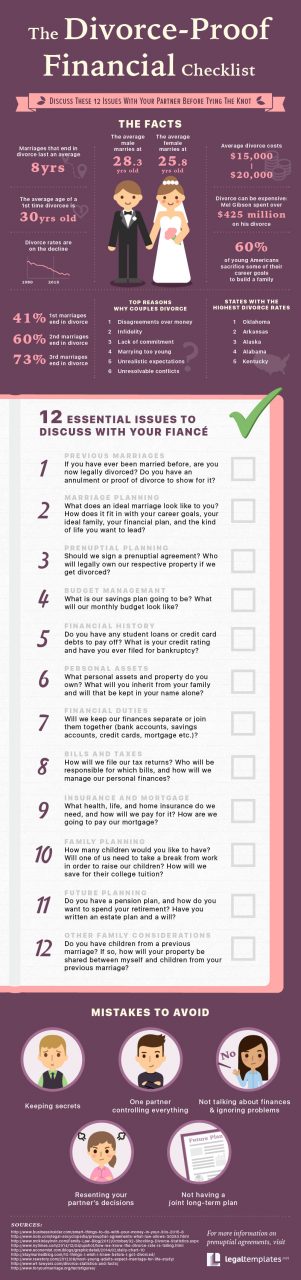

Review the following check list from our friends at Legal Templates and start planning your finances right away.