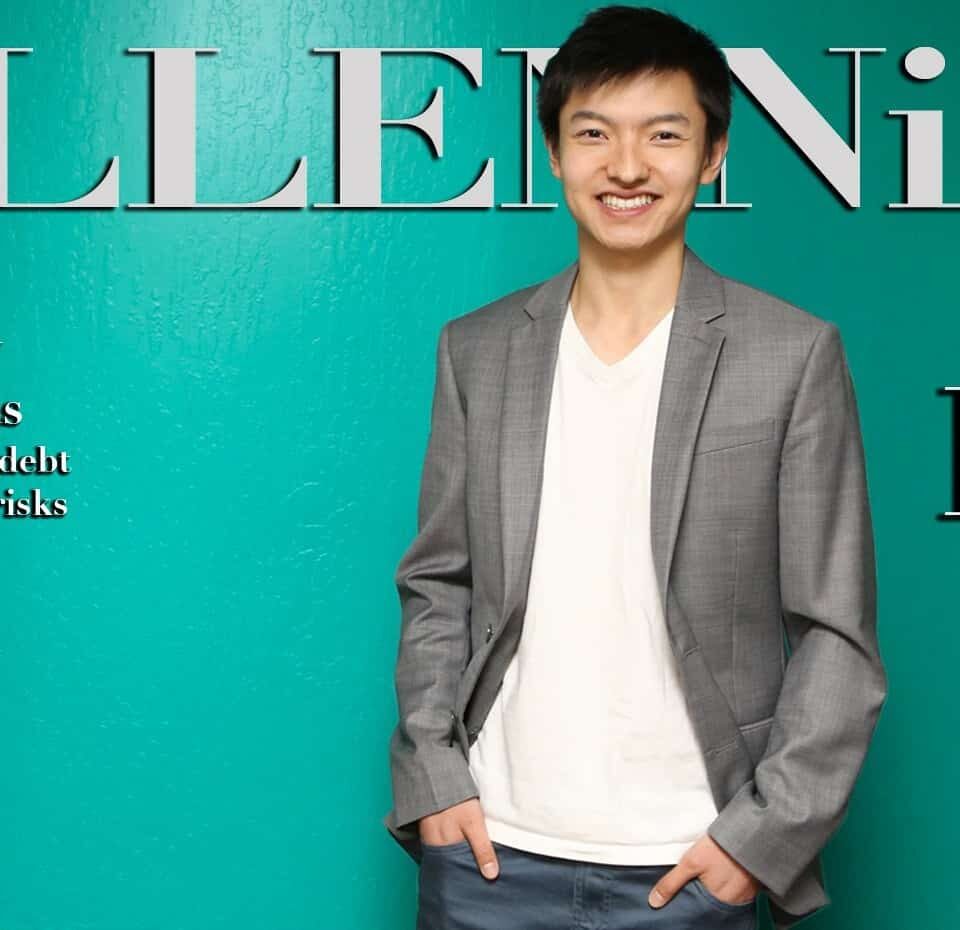

Paul Gu Tackles the Issue of Student Loans With Upstart

Qualifying for a loan can be an arduous task for most 20-30 year olds. Banks and other private lenders look at young adults who haven’t established their credit history as a big risk and charge a minimum interest rate of 22 percent to secure their financing. But this interest rate and drawn out process often deters millennials from pursuing a startup or consolidating their credit.

This scenario happened to 24-year-old, Paul Gu, when he was interested in obtaining a loan from a traditional lender. An Economics and Computer Science major from Yale University, Paul set out to change the finance game for millennials by creating a predictive modeling algorithm that measures the future income of those requesting a loan. This quantified theory has since turned into the popular peer-to-peer lending firm, Upstart.

MiLLENNiAL met up with Paul at his office in Palo Alto where he explained this business model and his journey leading up to its discovery.

From China to Yale

Born in China, Paul was brought to America at the age of six when his parents were accepted into Arizona State University. Coming from a typical immigrant family, Paul attended public school all his life and was often left home alone while his parents worked multiple jobs and attended class.

His father emphasized understanding math and science and would say things like, “Read the whole math text book. I’m going to quiz you.” This mentality led Paul to prefer teaching himself rather than learning in a classroom.

Eventually, Barnes and Noble became his babysitter, and everyday he would spend hours reading different material. He soon discovered the aisle dedicated to college prep and decided to do everything in his power to get accepted into a prestigious institution.

How Peter Thiel Sparked Genius in Paul Gu

While attending Yale in 2011, Paul was introduced to the Peter Thiel Fellowship, a program founded in 2010 designed to foster innovative entrepreneurs under the age of 20 by granting each $100,000 over a two-year period to launch a business or create a social movement.

After reading the details, he immediately applied, and to his surprise was accepted into the program’s second class. “There really wasn’t any question of whether this was an amazing opportunity or not,” Paul tells us.

“During the first year of the fellowship, leading up to the creation of Upstart, I learned a lot about what it really meant to start a company…I didn’t have a good conception of it before.” Prior to joining the fellowship, Paul explains that he had always wanted to start a business but wasn’t sure how one made the jump from college to entrepreneurship. This program became his guiding light.

“A big lesson for me was the importance of finding something within your core competencies.”

“A big lesson for me was the importance of finding something within your core competencies and core interests, and not trying to do something because you think that is the way others do it.” He had always enjoyed finance, and in particular, predictive modeling, but wasn’t sure how to create a solution to a problem in the market.

Then it clicked. The experience he had with obtaining a loan was a problem most people his age faced. If there were a way to predict future income, there would be a way to reduce interest rates and provide more loans. Thus, the foundation of Upstart.

Turning Upstart into a Multi-Million Dollar Company

During his time with the Thiel Fellowship, Paul crossed paths with Dave Girouard and Anna M. Counselman, two Google Enterprise executives who were looking for their next big project. Loving Paul’s idea to provide more students and post-graduates loan opportunities, the three quickly formed Upstart and started raising capital.

To date, the company has raised over $20 million dollars from investors like Marc Cuban, Eric Schmidt, and Marc Benioff, and has originated over $40 million in new loans.

“There is no question that I have been incredibly lucky to find the cofounders that I have and we complement each other in great ways. Both Dave and Anna have a lot more experience than me,” Paul says.

But as angel investor Geoff Lewis of Founder’s Fund tells us, “Paul is incredibly bold and incredibly data driven…that tends to be a really good combination…[and] the fact that he hasn’t done a lot of this is actually really positive. What you don’t know can end up helping you in certain businesses.”

From Income Sharing to Peer-to-Peer Lending

When Upstart first launched in 2013, their model was focused on an income share agreement between borrowers and lenders, meaning that instead of paying an interest rate, borrowers would give one to eight percent of their earned income to lenders for up to 10 years.

Early investor, Andy Palmer, suggests, “it’s going to take the world longer to get their heads around income shares.” To this point, in May of 2014, Paul and his team decided it would be best to cater to what was already the industry standard, but still be able to offer the lowest interest rates.

“The change that they made a year ago has really proven to be successful and Paul is at the heart of that,” Palmer tells MiLLENNiAL. “There is a personalized aspect to Upstart where they pride themselves on making their credit decisions based on knowing their borrowers better than anyone else and also in providing equal access for lenders in their platform.”

In order to qualify for a loan through Upstart, borrowers must have a college degree or be six months from graduating. Paul explains, “When we look at the data, what we consistently find is that having more education is strongly correlated with good economic outcomes.” This, in turn, results in making enough to pay back the loan on time and keeping interests rates fairly priced. Current Upstart interest rates start as low as five percent and go as high as 22 percent.

“It’s not necessarily the best algorithm and that makes me happy.”

Ironically, though, Paul never graduated Yale and due to his drop out status, can’t even qualify for a loan through his own company’s program. Commenting on this dilemma, Paul says, “It’s not necessarily the best algorithm and that makes me happy. It is kind of good knowing there are a lot of opportunities for us to continue improving the algorithm.”

He adds that the end goal is to have perfect predictions. “When you have perfect predictions, you get to have the lowest costs and you can save people more money as you get better at predicting.”

The Benefits that Come with Borrowing from Upstart

Dartmouth University senior and Upstart borrower, David Koffa, Jr. tells us he decided to apply for Upstart when he was rejected from a traditional lender. Koffa was looking to pay for relocation fees so he could take an internship with a non-profit in Washington D.C.

He says within 24 hours of applying to Upstart, he received a phone call from a representative who asked for additional records including transcripts, an offer letter, and any other documents that could prove his ability to pay back the loan. “Within three days I was approved and two days later I received the money…it was like lightning speed.”

Koffa credits his positive experience to the efficient and helpful nature of the Upstart staff. “They really care about the students.”

Palmer adds, “What we are doing is giving people options and a method of being more independent. And it is that independence that creates the willingness and ability to take on risk and do things that other people think is impossible.”

He emphasizes the importance of getting more capital into the hands of young people who want to take more risks and potentially “build something that is transformative for society.” Just as Palmer is helping Upstart provide loans to individuals looking to change the world, he is equally contributing to the success of Paul.

“Paul is an incredibly humble guy at his core…he is a powerful role model for other young entrepreneurs in Silicon Valley.” This non-elitist attitude Palmer speaks to is why Upstart has become a leader in their space.

To learn more about Paul Gu or Upstart visit their website and follow them on Facebook.