Financial risk teams are in charge of protecting companies from breaking rules, messing up operations, and market chaos. But often, they depend too much on spreadsheets.

Spreadsheets are okay for doing math, but they get messy fast when used to keep track of controls, due dates, and proof for audits. Teams can’t see what’s going on, and managers have a hard time getting a clear idea of the risk.

That’s why financial institutions and enterprises turn to the best project management tools. They need platforms that structure workflows, preserve documentation, and make compliance visible.

Lark provides these capabilities, giving risk teams a way to manage controls effectively and strengthen their overall financial risk management without drowning in endless spreadsheets.

Documenting frameworks with Lark Docs

Good risk management starts with clear documents. Policies and testing guides should be easy to find and always up-to-date.

If these things are scattered in emails and folders, people waste so much time searching, and they might even use old stuff by mistake. Lark Docs fixes this by giving you one place where everyone can work together.

Risk people can write policies, compliance teams can add the rules, and finance people can add the data to back it all up. You can see who changed what, and you can set permissions to protect stuff.

If you are changing a policy, compliance people can fix the wording, auditors can check the rules, and finance people can make sure things are doable, all in one Doc. This means your documents are correct, up-to-date, and ready for any audit.

Securing approvals with Lark Approval

Financial risk management and controls need constant oversight of things like risk reports, policy updates, or checks on outside vendors. If approvals are done through email, they can be easily missed or take too long, which puts groups at risk. Lark Approval makes this simpler with clear online steps.

Requests go to the correct people for review, and every choice is noted for responsibility. Say, before using a new investment platform, compliance people send a supplier risk management check through Approval.

Risk managers look it over, bosses okay it, and the choice is saved automatically. This record makes proving things during reviews easier and keeps choices open. Overall, Lark, as business process management software, gives financial risk leaders a structured, accountable system for financial workflows.

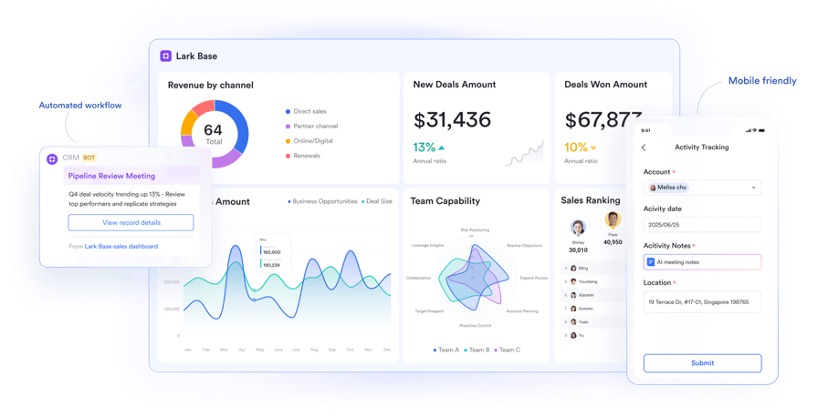

Structuring risk registers with Lark Base

Risk teams have to keep an eye on tons of controls, from market risk stuff to making sure they’re following the rules. Trying to keep track of all this in spreadsheets can get messy, and things can easily slip through the cracks. Lark Base gives you a simple way for risk teams to arrange their risk info and testing plans, and data management.

Custom tables in Lark CRM app allow tracking of risks, control owners, testing status, and remediation tasks. Automations reduce manual effort by sending reminders for overdue control testing or escalating high-severity findings.

For example, during a stress test exercise, Base can track each risk category, assign test owners, and link remediation efforts to deadlines. Leaders gain visibility, and teams ensure no control is left unchecked.

Meeting deadlines with Lark Calendar

Financial risk management works on a tight schedule with audits every quarter, stress tests each year, and regular paperwork for the government. If you miss these dates, you could get fined or your reputation could get hurt. Lark Calendar helps teams see these schedules clearly, so they don’t miss what’s coming.

Shared calendars show control reviews, audit dates, and when certifications need to be renewed. When you make tasks in Lark, they are reflected in Calendar automatically.

These lines up small things, like gathering evidence, with bigger goals, like submitting documents to regulators. Say you need to send in a yearly risk report.

Lark Calendar will show you the dates for check-ups, when they’re due, and when leaders need to sign off. Risk officers, compliance people, and finance heads all use the same schedule, which lowers the chance of anything slipping through the cracks.

Communicating updates with Lark Messenger

When handling financial risk management, lots of departments get involved—like finance, audit, compliance, and operations. If everyone’s just sending long emails back and forth, things get missed. Lark Messenger lets everyone share updates and work together as it happens.

You can create group chats for certain kinds of risks or audits. Threaded replies keep chats focused on what matters, and reactions let you quickly say got it. Say an auditor spots a problem.

They can post it in Messenger, the finance person can reply with proof, compliance can double-check the rules, and leaders can see how it gets fixed right away. Messenger keeps everyone in the loop and stops important things from getting lost in the shuffle, which is a common challenge for fast-moving startups.

Preserving audit lessons with Lark Minutes

Every audit or review produces lessons. If you don’t have a good system, these insights end up lost in notes or emails. For teams handling financial risk management, that means missed chances to strengthen controls and compliance.

Lark Minutes records conversations in searchable text, organizes them into smart chapters, allows you to replay video conferences, identifies speakers, filters their speech segments, and lets you drag and drop along the timeline for quick review.

For example, say a control test shows some problems in how risk is reported. The team has a meeting to talk it over. Minutes record why the problems happened, what fixes are needed, and when they should be done.

Later, when there’s another audit, the team can look back at these records to see if things have improved. This helps make controls stronger and shows regulators that the team is learning from its mistakes.

Streamlining Financial Risk Management with Lark

Financial risk teams don’t have to get bogged down in spreadsheets to handle controls well. By using Lark Docs, Base, Approval, Calendar, Messenger, and Minutes, they get tools that keep paperwork in order, speed up approvals, clarify communication, and make deadlines easy to see.

Risks are tracked the same way all the time, and audits go more smoothly. Also, banks and other financial places rely on trust and good relations with customers and partners. Lots of them use Lark to make sure risk management fits what customers want.